Bogdanka's record profits in 2023

The Management Board of Lubelski Węgiel Bogdanka S.A. has announced the preliminary financial and production results of the LW Bogdanka Group for 2023.

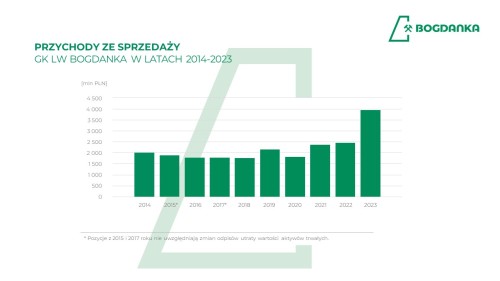

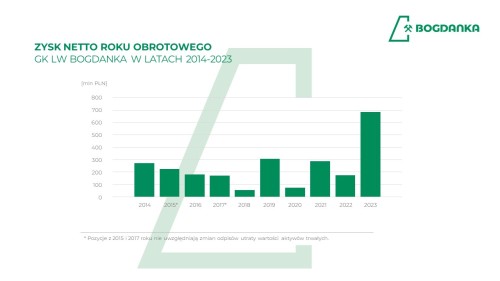

Sales revenues reached the highest result in the Group's history, i.e. PLN 3,939.3 million, EBITDA reached PLN 1,345.2 million and EBIT - PLN 839.8 million. Despite challenges in the first and second quarters of 2023 due to geological and hydrological difficulties, the Group achieved a record net profit of PLN 687.1 million for the full year of 2023. That is 391 percent more than in 2022. There is also a preliminary production plan for 2024, which provides for the production of approx. 9 million tons of commercial coal.

Commercial coal production in 2023 was 7.05 million tons, with sales reaching 6.7 million tons. This means that Bogdanka has met its annual production target announced on 25 July 2023.

It is worth mentioning that the July update of the production target was aimed at optimizing the company's operations, i.e. reducing the risks arising from the need to significantly accelerate mining in a market situation that did not guarantee the sale of the commercial coal produced.

Bogdanka's record profits confirm, on the one hand, the correct direction of the way the Company is managed and developed, and, on the other hand, prove the high commitment of the Workforce at every level. The Company is currently in a very good economic, financial, organizational and production position. The profits generated can now be used, among other things, to finance investments and implement the transformational goals assumed in last year's Company Strategy, such as becoming a multi-commodity company and diversification of revenues from renewable energy sources and circular economy

- said Kasjan Wyligała, President of the LW Bogdanka Management Board.

The situation at the mine today should also be regarded highly. After dealing with the geological and hydrological problems of the beginning of last year and stabilizing production, we achieved excellent results in Q4. This bodes very well for the future. The Company has rebuilt its production capacity and, based on this, we are assuming a preliminary production plan for 2024 of approx. 9 million tons of commercial coal,"

- Kasjan Wyligała added.

Last year's highest profits in the company's history are also a result of the efficiency of Bogdanka's sales force and its partnership relations with coal buyers, in particular the Enea Group's power plants. The cornerstones of this success are long-term contracts with prices negotiated at arm’s length and the efficiency and continuity of coal supply. Currently, transports are being carried out as planned. Parallel to domestic deliveries, we are pursuing commercial activities in the Ukrainian market. I would like to emphasize that the record profits generated have also created an adequate safety buffer for the smooth implementation of investments in RES and in typical mining projects. Ahead of us is a series of expenditures in new underground workings and in modernizing existing ones, as well as in maintaining the mine's machinery park

- said Dariusz Dumkiewicz, LW Bogdanka's Vice-President for Sales and Investments.

It was a really challenging year, but thanks to the ambitious attitude of the entire Workforce, we can be proud of the results today. Without the involvement of the miners, it would have been impossible to eliminate the problems with the squeeze of the longwall and water inflow at one of the longwalls, and then gradually stabilize production. In the second half of the year, the mine returned to optimal production capacity, as evidenced, for example, by October's record of longwall progress at Stefanów. However, the decision to operate a mix of 3-4 longwalls throughout the Company in 2023 turned out to be crucial. As a result, we were able to flexibly control the operations and increased production in Q4 to nearly 2.5 million tons of commercial coal, which is an optimal and exemplary result for Bogdanka

- said Adam Partyka, Vice-President of the Management Board for Labor and Social Affairs.

The record profits prove the validity of our current financial policy and strategy implemented throughout the LW BOGDANKA S.A. Group. They are also evidence of rational cost management in a difficult and challenging environment. I will remind you that in 2023 the Company was subject to wage pressures and had to face increases in the prices of production inputs, including electricity, materials or external services,

- said Artur Wasilewski, Vice-President of LW Bogdanka's Management Board for Economic and Financial Affairs.

Operationally and economically, the fourth quarter was the best, with net income more than 60% higher than the total for the previous three quarters of 2023. The cash flow generated by the Company provides stable financing for operating and investment activities, and allows it to share the generated profits with shareholders

- added Artur Wasilewski.

The final results will be presented in detail in LW Bogdanka S.A.'s financial statements and the consolidated financial statements of the LW Bogdanka Group for 2023.

Lubelski Węgiel Bogdanka S.A. is a leading hard coal producer in Poland that stands apart from its peers in terms of its modern and efficient mining. It is one of the largest Polish hard coal mines. Lubelski Węgiel Bogdanka S.A. chiefly conducts mining operations in terms of hard coal extraction, enrichment and sales. It supplies this raw material mainly to industrial offtakers. Supply contracts are long-term, and the product is sold to the commercial power sector and the industrial power sector.

The company has been listed on the Warsaw Stock Exchange since June of 2009. In August 2022, Lubelski Węgiel Bogdanka S.A. returned to listing on the WIG-ESG Index.

Since October of 2015 Bogdanka has been a member of the Enea Group, the second largest player on Poland’s electrical power market in terms of the generation of electricity, which manages the entire value chain on the electricity market ranging from fuel to the generation of electricity, distribution, sales (supply) and customer service.